ADNOC Gas Estimates That The Long-Term LNG Supply Agreement With IOC Is Worth $7-9 Billion

The latest long-term LNG purchase agreement between Indian Oil Corporation Ltd. (IOC) and Abu Dhabi’s ADNOC Gas is valued at $7-9 billion, the UAE-based gas giant said on Wednesday.

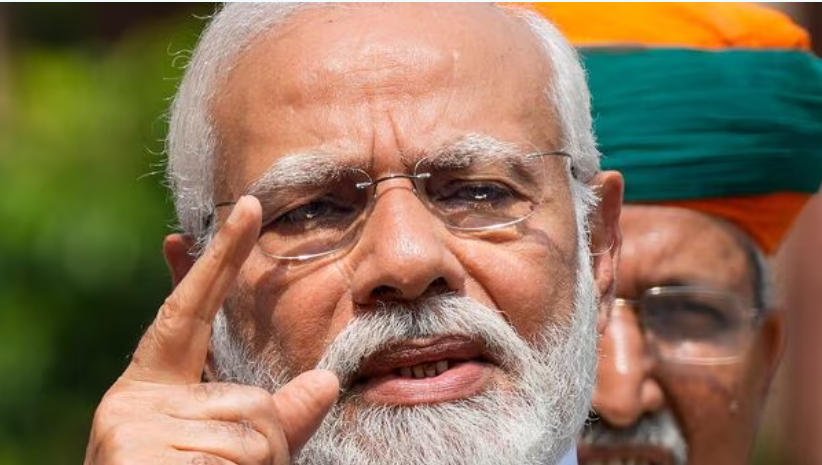

The deal, which was signed during Prime Minister Narendra Modi’s recent trip to France and the UAE, calls for the delivery of up to 1.2 million tonnes of LNG to IOC every year (mtpa) for 14 years, beginning in 2026.

IOC signed a new contract with France’s TotalEnergies for the purchase of 0.8 mtpa of LNG for 10 years, beginning in 2026, during Modi’s visit. However, neither IOC nor the government have made the deals’ values public.

These agreements between an Indian company and ADNOC Gas and TotalEnergies are the first-ever LNG term agreements. To ensure consistent supplies of super-cooled gas, India’s oil and gas industries, and public sector entities in particular, are looking for long-term LNG purchase agreements with international suppliers.

As the name implies, LNG is liquefied natural gas that is transported throughout the world on specialist tankers after being cooled to extremely low temperatures.

About half of India’s needs for natural gas are met by imports. Similar to many other nations, India wants to hasten the shift to green energy and sees natural gas as a crucial transition fuel.

By 2030, the Narendra Modi administration wants to see natural gas make up 15% of India’s primary energy mix, up from the current over 6%. This implies that India’s need for natural gas is anticipated to increase significantly over the next few years, which in turn implies that more LNG imports would be needed.

Although LNG can also be purchased through spot contracts, long-term agreements are thought to be preferable in terms of supply stability and pricing in a market that can be highly volatile globally.